Humanity Scale Healthcare Thesis

When Main Sequence was first established, it set 6 challenges it wanted to help solve with its investing and company creation strategy.

- Decarbonise the Planet

- Bridge The Gap to Space

- Next Intelligence Leap

- Supercharge Industrial Productivity

- Feed 10 Bn People

- Humanity Scale Healthcare

In the seven years since, our portfolio of over 60 companies represented the first five challenges quite robustly, but we haven’t invested in the sixth challenge area at the same rate. Plainly, this isn’t because there aren’t a plethora of fantastic healthcare and life science based deep tech opportunities in Australia — one of the world’s leaders in medical research.

In the last year Main Sequence has recruited a number of investment professionals, including three with healthcare investment experience, so this has given us the firepower we need to reboot our focus on this challenge area.

In the interest of transparency, we wanted to publish what our thesis is in this challenge area, to make it clear to companies looking for capital what we are interested in, and what we aren’t. We know what it’s like to raise capital as a founder, and often the opaque focus of investors can make targeting or curating investors tricky.

This thesis is a snapshot in time, based on what we have seen in the Australian landscape, on our strategy, portfolio construction and fund size considerations and our own experience building companies in this industry. However like all good investors, we have strong opinions loosely held, and its worth stating that this thesis may change and evolve over time as new information presents itself:

Product Category

We are open to investing in digital healthcare platforms, diagnostics, devices, and therapeutics, subject to the specific criteria outlined below for each category. We have a preference for products where MSV’s healthcare team has domain expertise or MSV’s broader investment team capability can add value (i.e. devices, hardware, and digital health).

Therapeutics

Diagnostics

Devices

Digital Health

Market Understanding

When assessing a healthcare opportunity, the team is looking for a company has an understanding of the path to market, a Key Opinion Leader (KOL) strategy, the regulatory strategy, its key customer base, who pays and drivers to adoption.

Innovative Deep Technology

Companies should possess defensible, novel technologies and or datasets.

Active Contribution

MSV can make a material contribution to the advancement of the company based on its expertise, networks, experience, and unique insights. For some healthcare investments, this assistance may be focused on helping entrepreneurs build and execute an asset strategy (where the asset/s is/are the products), with a clear set of value inflection milestones defined that will create value. We will have a preference for those opportunities where we can bring the broader, cross-disciplinary MSV expertise to bear — such as our expertise in synthetic biology, hardware, software, and other technology disciplines. We believe this will be a value-added differentiator from life science only investors.

Venture Scale and Speed

The product or platform must address a global market and have the ability to generate a venture-scale return within our investment horizon. This means we will focus on those companies that each have the capacity to return our fund.

Sector Focus

We believe taking a sector-agnostic approach in our healthcare challenge area is appropriate to optimise for opportunity flow, but where we have a preference for areas of special interest based on our domain expertise and the opportunity to impact our challenge area of achieving humanity-scale healthcare. These include the following:

Women’s health/Femtech;

There is a gender bias in healthcare. Studies show that resources are often disproportionately allocated to diseases that primarily affect men resulting in a sizable gap in the understanding of what we know about the female body. For example, as shared in Harvard Health, 70% of those affected by chronic pain conditions are women, whereas 80% of pain research is conducted on males. Recently, a new report, Closing Women’s Health Gap: a $1 Trillion Opportunity to Improve Lives and Economies, highlights the potential benefits of narrowing the gap in women’s health, emphasizing that it could lead to better quality of life for billions of women and substantial economic gains. We think a clear opportunity for improving humanity scale healthcare is to invest in these sectors that have been deprioritised for 50% of the population and where our definition of women’s health and femtech goes beyond reproductive health to include sectors such as menopause, endocrine disorders such as PCOS, ovarian cancer and other diseases that disproportionately affect women such as autoimmune diseases (see below).

Diseases of aging and management of aging population:

As our population ages, we are witnessing an increased prevalence of age-related disorders such as metabolic diseases, osteoporosis, dementia, ophthalmic conditions, cancer, and cardiovascular disease. This demographic shift places a significant burden on an already unprepared healthcare system, leading to increased clinician workload and reduced quality of care.

In Australia, healthcare expenditure related to aged care is projected to rise dramatically, expected to reach AU$320 billion by 2035 — a doubling since 2015. To prevent overloading our healthcare system, it is crucial to enhance healthcare services to more effectively care for this growing segment of the population.

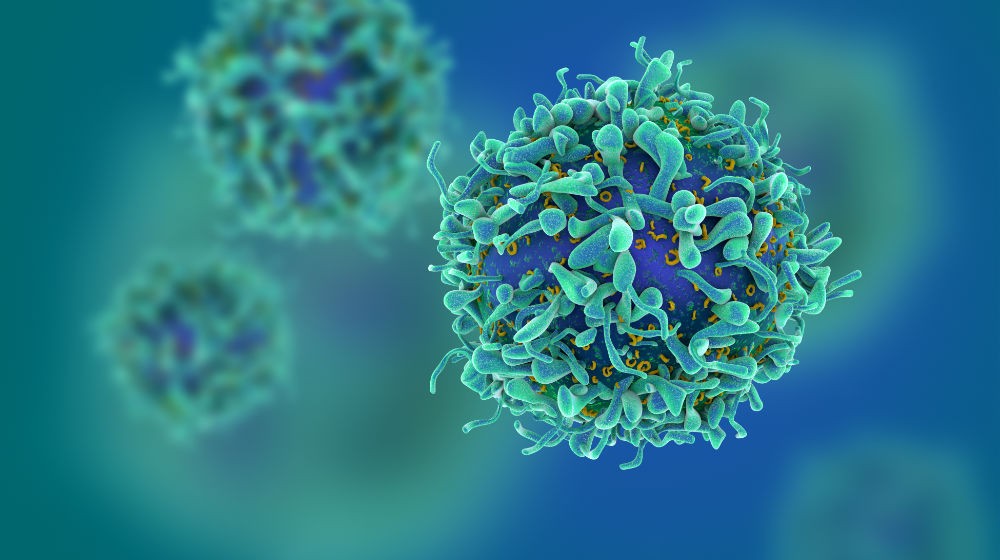

Autoimmune Diseases:

Autoimmune diseases are becoming increasingly prevalent, with nearly all lacking a definitive cure. These conditions are often debilitating, and while current treatments exist, they frequently come with severe side effects. Given the lack of curative options, treatments aimed at improving the quality of life for those affected by autoimmune diseases represent a significant unmet need.

Neurotech:

Addressing neurological and neurodegenerative disorders/conditions, such as dementia, parkinsons, motor-neurone disease, spinal conditions, migraine and traumatic brain injury with innovative approaches to treatment and support. Additionally there is emergence of non-invasive devices to better diagnose, monitor and intervene.

Preventative & Disruptive treatments:

Preventative medicine through disruptive therapies aimed at averting significant diseases, much like semaglutide’s wide-ranging (likely) longitudinal health benefits. Innovative treatments that offer early intervention and broad impact, fundamentally transforming healthcare from reactive to preventive.

As a company raising capital, we know what it’s like to lack clarity in what an investor is looking for and just as importantly, what it isn’t. Hopefully this helps to make the process a little less frictioned for all.

Written by

Stay in Touch

.jpg)